Data released today show that Greece climbed to second place in the absorption of funding from the European Fund for Strategic Investments.

Reeling from years of economic depression, Greece was the first EU country to avail itself of much-needed investment aid.

Public investment has hit rock bottom during the crisis, and small-and-medium-sized enterprises (SMEs) face a financial desert, as hardly any loans are issued by struggling Greek banks, which are sinking under the huge burden of non-performing loans (NPLS).

Greek banks have the highest rate of NPLs in the European Union.

Until now, Greece has signed contracts for 3.7 billion euros in projects, and amount that was invested in both important infrastructure projects and funding for businesses, mainly SMEs.

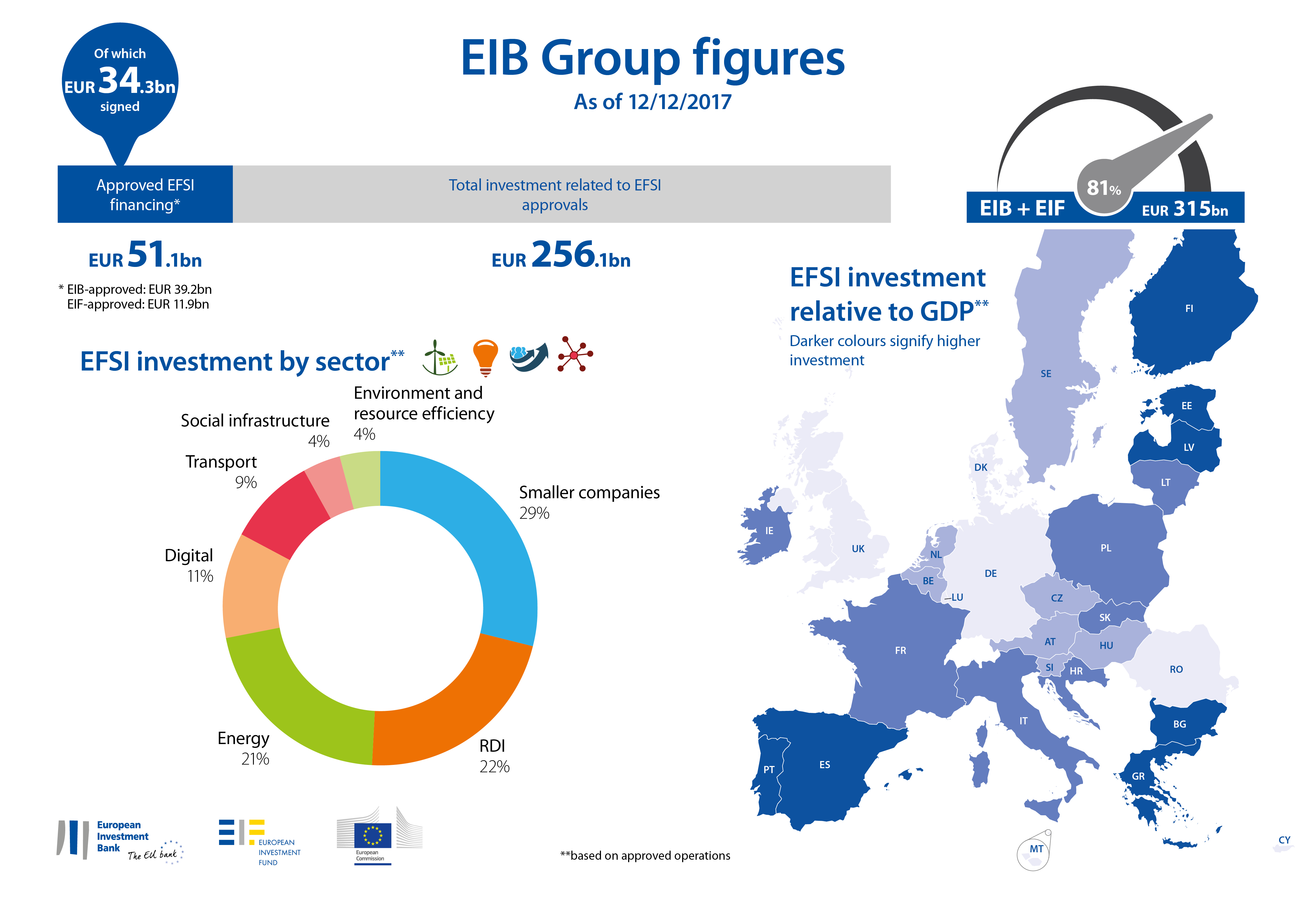

The good rate of absorption is in part due to Athens’ close cooperation with the European Investment Bank (EIB).

For 2016 and 2017, Greece and the EIB agreed to investment projects with an aggregate value of about five billion euros.

That was a 10-year record.

The agreements resulted in the injection of two billion euros into the Greek real economy, in 2017 alone.

For the next three years, seven billion euros worth of Greece-EIB projects are in the works.

That investment funding is expected to facilitate investments worth 20 billion euros, according to EIB projections.